People die according to a very accurate and predictable pattern. This pattern is determined by actuaries based on historical records and is called the Mortality Table. This table is used to determine the price of life insurance.

People die according to a very accurate and predictable pattern. This pattern is determined by actuaries based on historical records and is called the Mortality Table. This table is used to determine the price of life insurance. Let's take the above Mortality Table as an example. Statistically, we know that out of every 1000 person aged 45 years old, one will die within that year. We don't know who will die, just how many.

Let's take the above Mortality Table as an example. Statistically, we know that out of every 1000 person aged 45 years old, one will die within that year. We don't know who will die, just how many. Supposing these 45 years olds all wanted to purchase $1,000,000 worth of life insurance, we can determine exactly how much each person has to pay because we know exactly how many will die. This is called the Mortality Cost.

Supposing these 45 years olds all wanted to purchase $1,000,000 worth of life insurance, we can determine exactly how much each person has to pay because we know exactly how many will die. This is called the Mortality Cost. When the life assured is young, the mortality cost would be relatively low. This gives the immediate impression that Term Insurance is cheap. In this example, the mortality cost would be approximately $1000 in the first year. However, this cost would escalate as the insured gets older.

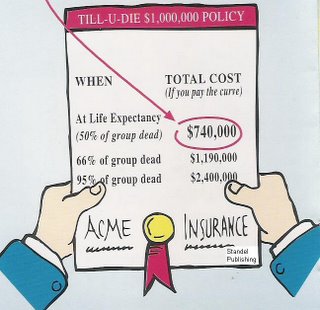

When the life assured is young, the mortality cost would be relatively low. This gives the immediate impression that Term Insurance is cheap. In this example, the mortality cost would be approximately $1000 in the first year. However, this cost would escalate as the insured gets older. If a person keeps paying according to the Mortality Cost Curve, the total amount paid accumulatively would be very huge. In fact, at life expectancy (the age when half of the people in the group will be dead), the total amount paid would have amounted to 74% of the policy face value.

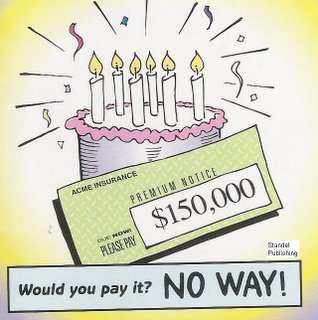

If a person keeps paying according to the Mortality Cost Curve, the total amount paid accumulatively would be very huge. In fact, at life expectancy (the age when half of the people in the group will be dead), the total amount paid would have amounted to 74% of the policy face value. Now, let's say you were one of the those 45 year olds. Today, you have just reached your life expectancy birthday! Your insurer sends you your premium notice. Instead of it being only $1000, which was the amount you started with, the premium is now $150,000. Would anyone be willing to pay it?

Now, let's say you were one of the those 45 year olds. Today, you have just reached your life expectancy birthday! Your insurer sends you your premium notice. Instead of it being only $1000, which was the amount you started with, the premium is now $150,000. Would anyone be willing to pay it?Term Insurance is exactly what its name suggest. Life insurance cover for a limited term. Once the term cover has expired, the person would be left vulnerable without any coverage. While most life insurers have guaranteed renewable options attached to their term policies, it might prove too expensive for most people to renew their Term Life Insurance coverage by that time. Normally, this would be the time when life insurance is most important and needed.

The purpose of this post is not to show that Term Insurance is not good. In fact, Term Life Insurance is a very powerful form of financial protection cover for everyone, especially those who are extremely tight on budget or have great risk for a fixed amount of time.

However, we should really reconsider our options before making the seemingly no-brainer descision to only purchase Term Insurance. In fact, we should always strive to convert our term protection to Whole Life Protection to ensure that premiums remain affordable while we remain protected for as long as we live, especially when we need the protection the most.

No comments:

Post a Comment