The Straits Times of Singapore carried this article dated 3rd Febuary 2006 with the title Investment-Linked Plans Exceed Sales of Other Life Policies.

It is interesting to note that it was only a few weeks ago that the same newspaper correspondent co-authored a whole section in the Straits Times about difficulties and challenges faced by the Financial Services industry. In fact, the same reporter created significant negative publicity in early 2005 for Investment-Linked Products (ILPs). Obviously, the statistics have proven otherwise.

What exactly are ILPs and why are they the most popular form of life insurance policies in Singapore today? ILPs are also known as Variable Universal Life (VUL) Insurance plans in some countries. It combines permanent insurance protection with investment flexibility. They are available both as regular premium and single premium plans.

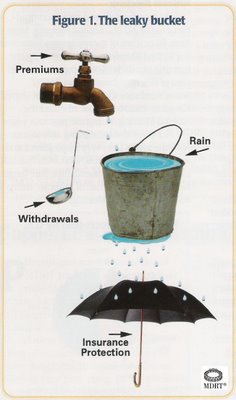

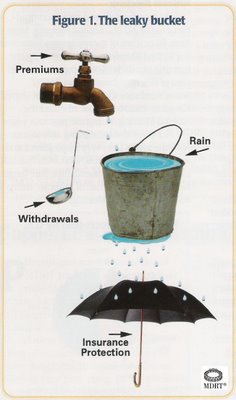

As with any life insurance product, ILP replaces the permanent premature loss of income to a person and his/her dependents. To illustrate this concept, I shall use the following diagram (Figure 1) taken from an official Million Dollar Round Table publication.

As with any life insurance product, ILP replaces the permanent premature loss of income to a person and his/her dependents. To illustrate this concept, I shall use the following diagram (Figure 1) taken from an official Million Dollar Round Table publication.

The premium a client pays can be likened to water coming out of the tap. Those premiums (i.e., the water) go into a bucket. Now, imagine a rusty hole at the bottom of the bucket, and that water is leaking out. The water leaking out of the bucket can be likened to the monthly deduction taken from the client's policy to keep the life insurance in force.

The tap can be set so that the amount of water coming out exactly equals the rate at which water leaks out at the bottom. This is the way a pure, term-to-age-100 policy works, assuming level cost of insurance. The only problem is that if a premium is missed, the coverage is lost.

However, the tap can be set so that more water goes into the bucket than is needed. This way the client builds up some reserve in the bucket. What happens to the reserve, or cash value, is up to the client.

In Singapore, these cash values are usually invested in various investment funds managed by the insurance companies offering these types of policies. These investments generate interest and capital appreciation, which is added to the water in the bucket (similar to water "raining" into the bucket, i.e. coming from somewhere other than the tap).

The client's objective in building up the amount of water in his/her bucket - through premium payment and investment earnings - is to get the water level to a point whereby the amount of rain equals the amount of water leaking out at the bottom. At this point, the client can suspend further premium payments, using investment income to pay for his/her life insurance.

Obviously, at the point of death or total-and-permanent disability, the insurance company pays out the guaranteed sum assured plus the full amount of water in the bucket. Another very important point is that in the event the client has more water in his/her bucket than is needed to carry the cost of insurance then, as with any good rain barrel, he or she can dip into the bucket and take some water out.

Simply put, ILP is life insurance with flexibility at its best! Do note however, that ILPs may not suit everyone, especially clients approaching their 50s and above.

In it, the writer expresses his concern regarding the increasingly-high price of financing the already-high cost of cancer treatment. This is a fact known to all, although many Singaporeans are still not ready to take the necessary steps to ensure that they are adequately prepared in the event that someone in the family suffers from cancer.

In it, the writer expresses his concern regarding the increasingly-high price of financing the already-high cost of cancer treatment. This is a fact known to all, although many Singaporeans are still not ready to take the necessary steps to ensure that they are adequately prepared in the event that someone in the family suffers from cancer.