Often however, the diagnosis of cancer have wiped out the savings of many families who are not prepared and did not have Critical Illness protection in place. Many families even have to borrow to pay for the high costs of medical treatment.

Recently, I chanced upon an article originally published in the Straits Times on 23rd October 2005, exactly four months ago today.

In it, the writer expresses his concern regarding the increasingly-high price of financing the already-high cost of cancer treatment. This is a fact known to all, although many Singaporeans are still not ready to take the necessary steps to ensure that they are adequately prepared in the event that someone in the family suffers from cancer.

In it, the writer expresses his concern regarding the increasingly-high price of financing the already-high cost of cancer treatment. This is a fact known to all, although many Singaporeans are still not ready to take the necessary steps to ensure that they are adequately prepared in the event that someone in the family suffers from cancer.

What really struck me about the article was this; that chances of someone being diagnosed with cancer in Singapore is one in 3. Sometimes, I would say to my clients and the prospects I meet that approximately one in 25 women would get breast cancer in their lifetime and they would dismiss me as axeggerating. In fact, I've read that the figure may be as high as one in 8 women. But one in 3 Singaporeans to be diagnosed with cancer in their lifetime?

This simply renews my resolve to speak to as many people as possible about financial protection for themselves and their loved ones. I cannot ensure that they do something, but at least I could help create awareness regarding an increasingly common illness and the financial burden it causes.

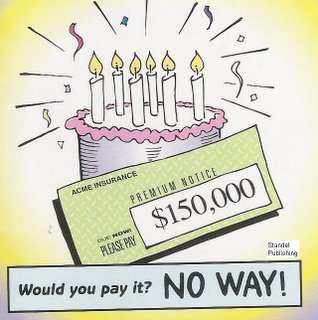

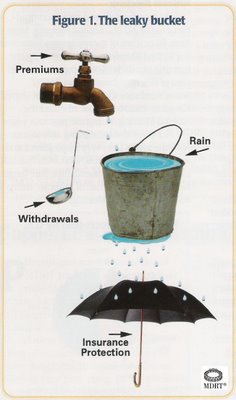

We might not be able to prevent cancer, but almost every single Singaporean can afford the insurance premium for Critical Illnesses insurance.

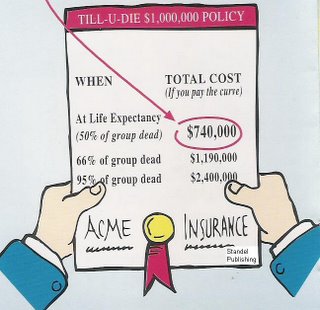

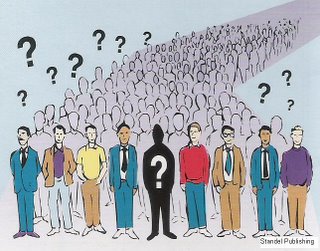

Let's take the above Mortality Table as an example. Statistically, we know that out of every 1000 person aged 45 years old, one will die within that year. We don't know who will die, just how many.

Let's take the above Mortality Table as an example. Statistically, we know that out of every 1000 person aged 45 years old, one will die within that year. We don't know who will die, just how many.